Instructions

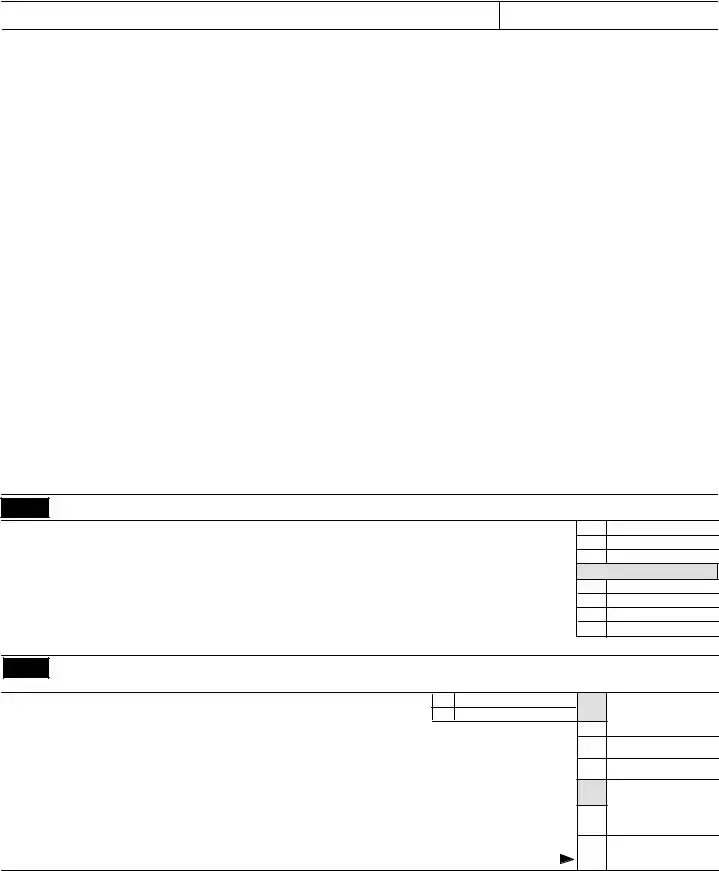

Who Should Use This Form.--Use this form to see if you must pay a penalty for underpaying your estimated tax. Complete Part I to determine the required annual payment. Complete either Part II or Part III to determine the penalty that you owe. If you are a farmer or a fisherman and pay the tax due by March 1, 1999, do not file this form since you do not have to pay a penalty.

NOTE: If you were not required to file a 1997 North Carolina income tax return, STOP HERE. You do not owe the penalty and you do not have to complete this form.

Short Method

You may use the short method only if:

. You made no estimated tax payments (or your only payments were withheld North Carolina income tax); OR

. You paid estimated tax in four equal amounts on the due dates.

NOTE: If you made estimated tax payments, the short method will give the precise penalty amount only if your payments were made exactly on the due dates. If any payment was made earlier than the due date, you may use the short method, but using it may cause you to pay a larger penalty than the regular method. If the payment is only a few days early, the difference will generally be small. Do Not use the short method if you made any of your payments late. Important: A farmer or fisherman cannot use the short method to

determine the penalty since the penalty for a farmer or fisherman is determined in the last quarter only.

Regular Method

Use the regular method to figure the penalty if you are not eligible to use the short method. To use the regular method, complete Part I below and Part III on the back.

Line--By--Line Instructions

Line 6 -- If this line is less than $1,000, you do not owe a penalty and need not attach this form to your tax return.

Line 7 -- Figure your l997 tax by subtracting the tax credits on line 15 from the tax on line 12 of your 1997 return.

If you were required to file a return for 1997 but have not filed, do not complete this line. Instead, enter the amount from line 4 on line 8.

Line 16 -- If your income varies during the year, for example you receive unexpected or seasonal income not subject to withholding in April or later, you may be able to lower the amount of your penalty by completing Form D--422A, Annualized Income Installment Worksheet. If you annualized your income for any payment period, you must annualize it for all payment periods.

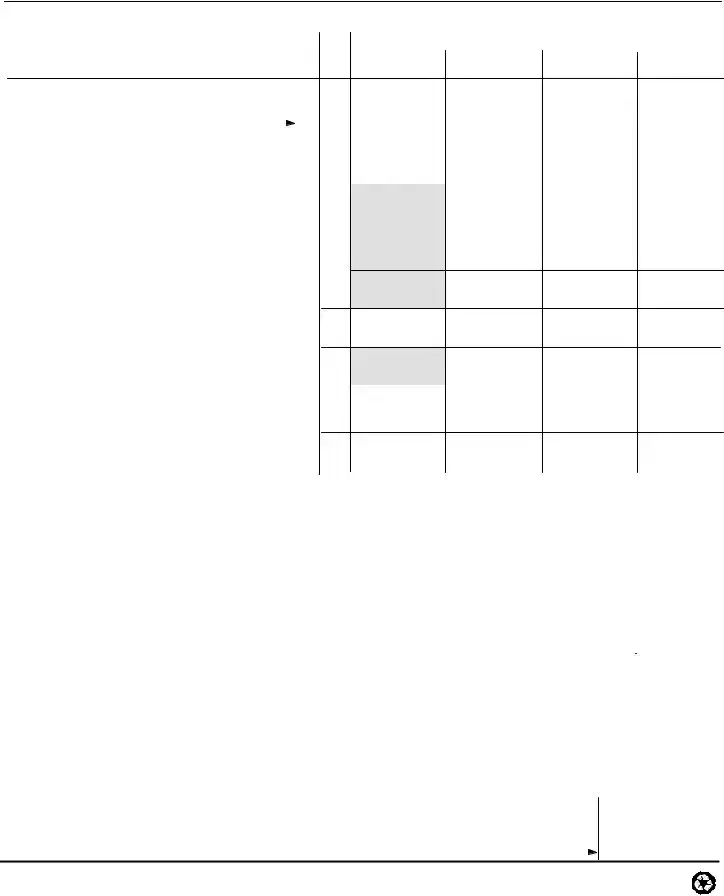

Line 17 -- Complete line 17 as follows:

. You are considered to have paid any

withheld State income tax evenly over the period you worked during the year unless you can show otherwise. If you worked all year, divide the total amount withheld by 4, and enter the result in each column.

. Include your estimated tax paid for each

payment period. Also include any 1997 overpayment of tax which you elected to apply to your 1998 estimated tax. If you file your return and pay the tax due by January 31, 1999, include on line 17, column (d), the amount of tax you pay with your return.

Line 23 -- If you do not show an underpayment on line 23 for columns (a), (b), (c), or (d), you need not attach this form to your tax return unless you annualized your income.

Line 25 -- Figure the number of days after the due date of an installment through December 31, 1998, or through the date the estimated tax was paid regardless of which installment the payment was for. For example, if line 23, column (a) shows an underpayment, any later payment of estimated tax is considered the date line 23, column (a) was paid to the extent of the underpayment. If December 31, 1998 is earlier, enter 260, 199, and 107 respectively in columns (a), (b), and (c).

Line 27 -- Enter the number of days after December 31, 1998, through the date the estimated tax payment was made, or through April 15, 1999, whichever is earlier. If April 15, 1999, is earlier, enter 105 in columns (a), (b), and

(c) and 90 in column (d).